Bitcoin fills July CME gap 'to the dollar' amid $104K BTC price target

Cointelegraph

2025-08-01 15:44:00

Key points:

Bitcoin seals another multi-week low, this time filling a July gap in CME’s Bitcoin futures market.

Traders hold mixed views of where BTC price will head next.

US trade tariffs appear to impact Bitcoin and crypto more than US stocks.

Bitcoin hit new three-week lows Friday as US trade tariffs soured market sentiment.

BTC price ticks off $114,000 CME gap

Data from Cointelegraph Markets Pro and TradingView showed falling to $114,322 on Bitstamp before bouncing.

In doing so, the pair entirely filled a “gap” in CME Group’s Bitcoin futures markets left over from July.

As Cointelegraph continues to report, price tends to “fill” these gaps, which often appear at weekends, within weeks, days or even hours of the market reopening.

$BTC CME gap filled to the dollar.

Bounce time? https://t.co/yojdjBcJvq pic.twitter.com/bhHy4NcFOZ

“We should see a nice upwards movement now,” crypto investor and entrepreneur Ted Pillows predicted in part of a response on X.

Some market participants remained cautious. Bitcoin, they argued, needed to show more strength to avoid the risk of a further breakdown.

“Now that the gap is tapped, we watch closely,” popular trader Cipher X told X followers, flagging $104,000 as a potential downside target if $116,000 was not reclaimed.

Popular trader Crypto Candy said the price needed Friday’s daily close to be above the $115,00-$116,700 area.

“If it fails to sustain, then we may see it at the 111.8k area before the next leg up to ATH,” he warned.

Bitcoin suffers while stocks shrug off tariffs

Bitcoin thus fell harder than risk assets on the day as the Donald Trump administration enacted sweeping reciprocal tariffs.

By comparison, S&P 500 futures were down a modest 0.4% at the time of writing before the Wall Street open.

Commenting, trading resource The Kobeissi Letter saw the market already comfortable with trade war surprises, acclimatizing since April.

“The market says the trade war has lost all credibility,” it summarized, suggesting that S&P losses would have hit 3% had the tariffs gone ahead four months ago.

Stocks nonetheless joined Bitcoin in whipsaw moves, the day prior having seen the S&P in all-time high territory thanks to tech earnings beating expectations.

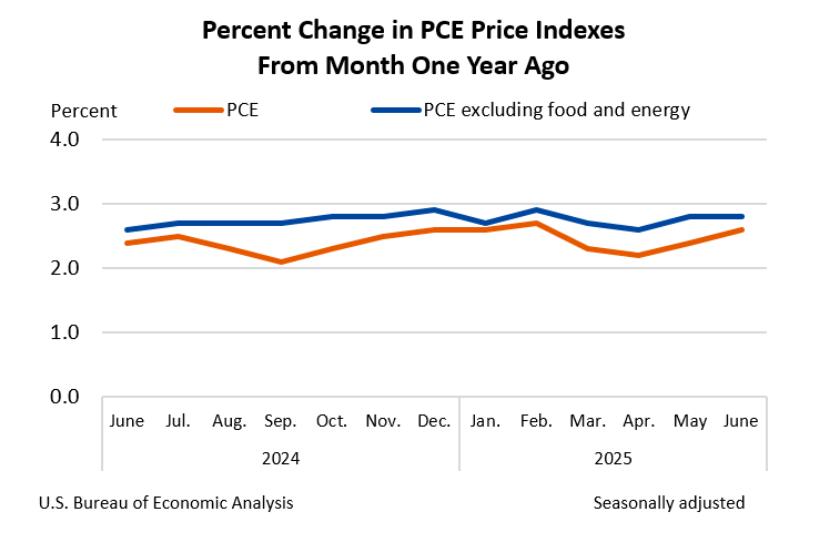

This came despite the Personal Consumption Expenditures (PCE) index, known as the Federal Reserve’s “preferred” inflation gauge, coming in above estimates.

Earlier in the week, Fed Chair Jerome Powell struck a hawkish tone while leaving interest rates unchanged, leading markets to price out rate cuts in 2025 — a headwind for risk assets.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

最新の速報

CoinPost

2025-08-06 06:02:17

CoinPost

2025-08-06 05:40:28

CoinPost

2025-08-06 05:20:13

CoinPost

2025-08-06 04:50:54

CoinPost

2025-08-06 04:30:27