Global crypto funds see outflows of $223 million for first time in 15 weeks amid profit-taking and hawkish Fed signals: CoinShares

The Block

2025-08-04 17:39:02

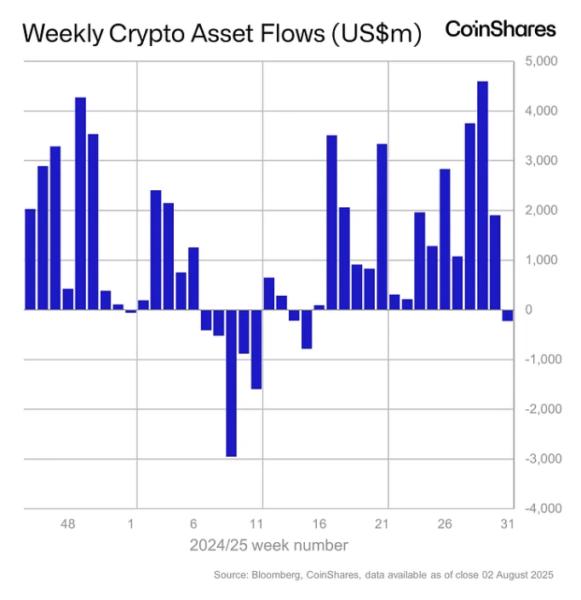

Crypto investment products managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares recorded $223 million in net outflows globally last week, ending a 15-week run of consecutive inflows, according to CoinShares data.

Although the week had started strong, attracting around $883 million worth of net inflows in the first few days, substantial outflows in the latter half saw the funds flip negative overall. This was likely triggered by the hawkish FOMC meeting and a series of better-than-expected economic data from the U.S., CoinShares Head of Research James Butterfill noted in a Monday report.

"While the weak payrolls data at the end of the week had dovish connotations for the Fed, general risk-off sentiment led to further outflows, with over $1 billion on Friday," Butterfill said. "Given we have seen $12.2 billion net inflows over the last 30 days, representing 50% of inflows for the year so far, it is perhaps understandable to see what we believe to be minor profit taking."

Weekly crypto asset flows. Images: CoinShares.

Bitcoin dominates outflows while Ethereum's positive streak continues

Regionally, the U.S. led the negative sentiment with net outflows of $383 million, followed by Germany and Sweden crypto investment products, with $35.5 million and $33.3 million, respectively. However, this was offset somewhat by net inflows of $170.4 million and $52.4 million from funds in Hong Kong and Switzerland.

Bitcoin-based funds dominated the overall picture, witnessing $404 million in net outflows last week. "Nonetheless, year-to-date inflows remain strong at $20 billion, an understandable dynamic given bitcoin's sensitivity to monetary policy shifts," Butterfill said.

The U.S. spot Bitcoin ETFs accounted for the majority of that figure, losing $642.9 million last week, according to data compiled by The Block, offset by inflows to funds in other regions.

Meanwhile, Ethereum-based funds added another $133 million in net inflows to post their 15th consecutive week of inflows — the longest streak since mid-2021 — demonstrating "robust positive sentiment" for the asset, Butterfill said.

The U.S. spot Ethereum ETFs also dominated this figure, accounting for $154.3 million of last week's inflows, despite suffering $152.3 million worth of net outflows on Friday.

In terms of other altcoin-based investment products, XRP, Solana, and Sei funds also registered net inflows of $31.2 million, $8.8 million, and $5.8 million last week, respectively.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

最新の速報

CoinPost

2025-08-09 08:00:08

CoinPost

2025-08-09 08:00:08

CoinPost

2025-08-09 07:25:43

CoinPost

2025-08-09 07:25:43

CoinPost

2025-08-09 06:00:46